Despite ever-advancing technologies tailored to protect consumers from falling victim to fraud, scammers are still finding ways to get access to your information, hence the nearly $40B that Americans lost in 2022 to phone scams.

Below, we'll share real-life examples of the most common scams, offering insights on how to protect yourself and your accounts from potential scams.

Key Takeaways

1

Stay Informed: Understanding common scams is your first defense against fraud.

2

Verify Before Acting: Always research and verify any organization's or individual's legitimacy before making donations or sending money.

3

Secure Personal Information: Be cautious about sharing personal details, especially with unsolicited calls or online requests.

4

Use Official Channels: For activities like checking gift card balances, stick to official websites or customer service numbers to avoid scams.

5

Be Skeptical of Unsolicited Calls: Approach unexpected offers or requests for personal information with skepticism, especially from robocalls.

Scenario #1: Charitable Scams

Charitable scams have increased in popularity, and fraudsters prey on generous individuals.

What Happens?

You receive an emotional phone call about a recent natural disaster. The caller, sounding distressed, claims to represent a nonprofit helping children affected by the tragedy and needs donations.

Moved by the plea, you quickly donate $100.

What is the Result?

Later, you realize the "nonprofit" doesn't exist, and your money goes straight into a scammer's pocket.

You contact FSB with your concerns and discover this has happened to multiple customers over the last few weeks.

How Can You Prevent This?

-

Research Before Donating: Scammers often claim to represent nonexistent nonprofits. Sometimes, they might even use a legitimate organization's name but pocket your donation for personal gain. Always research the organization first, no matter how urgent they make it seem.

-

Check for an EIN: Genuine nonprofits will have an Employer Identification Number (EIN) on their website. If you can't find an EIN, be wary.

-

Know the Cause: If you find an EIN, read about the nonprofit's cause. If it doesn't align with the donation request, it might be a scam.

Always trust your instincts. If a call feels off, especially in person or over the phone, it's okay to say no and verify the organization later.

Scenario #2: Romance Scams

While romance scams have been an ongoing form of fraud, many are still falling victim.

What Happens?

You meet a guy by the name of Alex on a dating app. He's a few states away but constantly mentions his eagerness to visit you.

After weeks of chatting, Alex shares a story about a sudden medical emergency and needs financial help. Wanting to help your new "partner," you send $500.

What is the Result?

After sending the first $500, Alex's misfortunes seem to multiply. He now needs money for car repairs and to cover his rent.

You start questioning him and wondering when he will finally visit you.

After you refuse to send him money, Alex's profile mysteriously disappears, leaving you with the sinking realization that you've been scammed.

How Can You Prevent This?

-

Stay Vigilant on Social Media and Dating Apps: Scammers use these platforms to initiate romance scams, often telling the victim they live in another state but would love to visit. This becomes a red flag once they ask you for money.

-

Take Things Slow: If someone is rushing a relationship or making urgent requests, it's a red flag.

-

Avoid Sending Money to Strangers: No matter how convincing their story is, avoid sending money to someone you have yet to meet. Scammers often ask for wire transfers or gift cards, which are hard to trace, which is another red flag.

If something feels off or too good to be true, it probably is. Always prioritize your safety and well-being.

Scenario #3: Gift Card Scams

Did you know scammers have found a way to deplete the funds from a gift card before you can use it?

Scammers will do this in one of two ways - by tampering with the card before it’s purchased or through fraudulent websites that claim to be for checking your balance.

What Happens?

You decide to buy a gift card as a present for a friend's birthday. While browsing the gift card rack, you pick one that looks just like all the others.

After purchasing, you give it to your friend. When they try to use it, they find out the balance is already zero.

In another scenario, you receive a gift card and check the balance online. You find a website that claims to provide balance checks for various gift cards.

After entering your card details, not only is the balance incorrect, but the entire amount on the card is spent within hours.

What is the Result?

In both situations, the scammer has successfully drained the funds from the gift card.

You or your friend are left with a worthless piece of plastic, and the money spent on the card is now in the scammer's pocket.

You're left sitting there wondering how this happened.

How Can You Prevent This?

-

Inspect Before Buying: Always check gift cards for any signs of tampering before purchasing. Ensure the security seal matches other cards and shows no signs of being replaced. Choose a different gift card if anything seems off.

-

Use Official Balance Checks: Only check your card balance by calling the number on the back or visiting the official website. Relying on third-party sites can expose you to potential fraud.

-

Avoid Third-Party Sellers: If buying a gift card from a third party, ensure they are reputable and have positive reviews. Always remember if something seems too good to be true, it probably is.

Scenario #4: Robocalls

Robocalls are, perhaps, one of the most commonly experienced forms of fraud.

What Happens?

In scenario one, you receive an unexpected call from an unknown number. The automated voice on the other end informs you that your car's extended warranty will expire.

They offer a one-time deal to renew it over the phone. The offer sounds tempting, especially since you planned to extend that warranty anyway.

In another scenario, you receive a call from someone claiming to be from the Social Security Administration.

They sound concerned and inform you that there's been suspicious activity linked to your Social Security number.

They urgently explain that your number might have been compromised and used for illegal activities, and they need to verify it to access your account.

What is the Result?

In the first situation, after providing the details they ask for, you later find unauthorized charges on your credit card or discover that your personal information has been compromised, leading to potential identity theft.

You should contact your financial institution immediately.

In the second scenario, once you've shared your Social Security number, the scammer has the key to a wide range of fraudulent activities, from opening new credit accounts in your name to filing false tax returns.

You're left dealing with the aftermath of identity theft, a compromised credit score, and restoring your financial security.

How Can You Prevent This?

-

Stay Skeptical: Always be wary of unsolicited calls, especially those that ask for personal or financial information. Never provide personal or financial details over the phone unless you initiated the call and trust the recipient.

-

Verify Independently: If a call seems suspicious or too good to be true, contact the company or organization directly using a trusted number.

-

Use Call-Blocking: Consider using call-blocking tools or apps to prevent unwanted robocalls.

A good rule of thumb for avoiding robocall scams is always to assume they are scams.

It's important to remember that it's incredibly rare for any personal information to be requested from you if you are not initiating the call.

Reporting Fraud

Avoiding falling victim to fraud may seem daunting, but knowing the signs is the first step to arming yourself. As scams grow more elaborate, never be afraid to question anything suspicious.

Staying aware and informed is the best tool to secure your finances and protect yourself from the repercussions of fraud.

If you have any doubts or concerns, please don't hesitate to contact FSB.

Related Articles

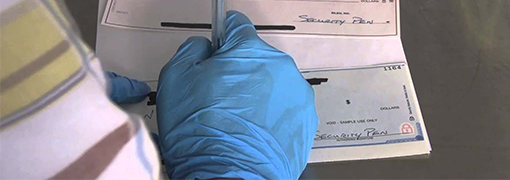

Check Washing

Discover how to prevent your checks from being altered and cashed.

Online Banking Security Tips

Enhance your online security to defend against digital fraudsters.

Identifying Grandparent Scams

Learn how to spot grandparent scams and protect yourself from fraud.