Stay Ahead of Emerging Fraud Threats

Fraud tactics continue to change as scammers use new tools and technology to target both consumers and businesses. Learn about the latest trends, what they look like, and how to protect your accounts before a scammer has the chance to act.

Reporting Local Fraud

If you suspect fraudulent activity or have concerns about your account security, please call FSB directly at (319) 377-4891.

Current Fraud Trends

Review the scams affecting people across Iowa and beyond, and see the steps that help you recognize and stop them early.

Consumer Fraud Trends

Arm yourself against fraud with expert insights on the latest Iowa trends.

Business Fraud Trend

Learn about the latest business fraud affecting Eastern Iowa organizations.

One Mistake Nearly Cost Thousands

See how a quick verification call stopped a $300,000 loss.

Counterfeit Money

Recognize the signs of counterfeit money to protect yourself.

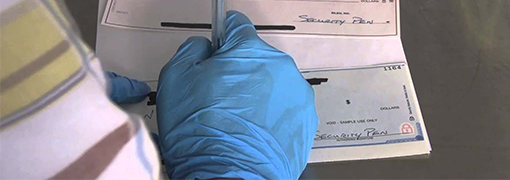

Check Washing

Discover how to prevent your checks from being altered and cashed.

Computer Security Tips

Enhance your online security to defend against digital fraudsters.

Identifying Phishing Attempts

Learn the communication tactics scammers use to trick you.

Stop Business Email Scams Early

Learn how to protect your business from email fraud.

Identifying Grandparent Scams

Learn how to spot grandparent scams and protect yourself from fraud.

Preventing Social Security Fraud

Find out how to spot and prevent Social Security fraud.

How AI Is Changing Scam Tactics

See how AI tools help scammers create convincing calls, videos, and more.

Spotting Fraud Business Calls

Learn how scammers impersonate vendors and how to verify every call.

Everyday Scams in Iowa

Learn how local Iowans spotted scams before losing money.

How Verification Prevented Loss

Learn how one business avoided a $17,000 payment scam.

Act Fast to Protect Your Money

See the steps to take right away if you sent money to a scammer.

Fraud Articles Listed

Local Fraud Trends

Money Fraud

Online Security

Targeted Scams

Stay in the Know

Get instant notifications about account activity to help you quickly catch any unauthorized transactions.