The Different Types of Phishing Scams

Cyber scams such as Phishing, Vishing, Mishing, and Smishing are becoming increasingly easier for fraudsters. It might seem like a lot of 'ishing,' but what exactly do these phrases mean?

Table of ContentsAdditional Fraud Tips

Phishing: The Deceptive Email Trap

Vishing: The Voice Phishing Scheme

Phishing scams are typically conducted through emails designed to deceive you into giving out personal information. These emails often impersonate reputable institutions and may request you to verify account and/or personal information.

Impersonation: The email uses legitimate institutions' logos and similar message formats.

Generic Greetings: The email addresses you as 'account holder' or 'customer' rather than by your name.

Spelling or Grammar Mistakes: These emails often contain noticeable spelling or grammar mistakes.

Fake Signatures: They may be signed with a fabricated employee name or vague terms like 'online banking team.'

Vishing employs telephone communication, often automated, to scam individuals. Scammers may pose as representatives of fake charities, relief funds, or lotteries to extract information or money.

Automated Calls: Most vishing calls use voice or telephone communication, often sounding robotic.

Too Good To Be True: Scammers often pretend to represent relief funds or lotteries to extract information or money.

Urgency: The scammer may create a sense of urgency, pressuring you to act immediately.

Mishing involves scammers using mobile phones to pose as employees from reputable organizations, seeking to obtain your details under false pretenses.

Mobile Communication: Mishing involves mobile phones, typically through text messages.

Impersonation: Scammers pose as employees from your financial institution or another organization, claiming to need your details.

Verification Requests: Scammers might use mishing to verify your account information or to authorize purchases.

Smishing scams involve fraudulent text messages, often claiming to be from your bank, asking you to confirm or decline transactions.

For instance, if you receive a text appearing to be from FSB about a Zelle® transfer, it's a scam. FSB does not notify customers via text about potentially fraudulent Zelle transactions.

Fake Notifications: You may receive texts appearing to be from your bank asking you to confirm or decline transactions.

Urgency: The text may urge you to act quickly, aiming to prevent you from thinking or verifying the information.

Contact Information: Never use the contact information provided in the text; instead, verify it independently.

Your first line of defense against various cyber scams is awareness and staying proactive.

Here are some steps you can take to protect yourself from falling victim to cyber scams:

Stay Informed: Regularly educate yourself about the latest scams and tactics used by fraudsters. Being aware is crucial in recognizing and avoiding scams.

Verify Information: If you receive suspicious emails, calls, or texts, verify the contact details independently before responding. Never use the contact information provided in the suspicious message.

Use Secure Communication: When in doubt, use verified and secure channels to confirm the legitimacy of any requests for information or money.

Pause When Pressured: Scammers often create a sense of urgency to provoke immediate action. Take a moment to think and verify before acting on any urgent or unexpected requests.

Report Suspicious Activity: If you encounter any suspicious activity, report it immediately to your bank or the appropriate organization. Your quick action can help mitigate damage and help others avoid being scammed.

If you have any doubts or concerns, please don't hesitate to contact FSB. The bank is here to assist you in securing your information and protecting you from fraudulent activities.

Enhance your online security to defend against digital fraudsters.

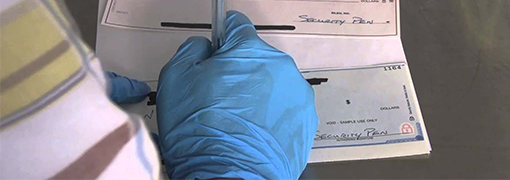

Discover how to prevent your checks from being altered and cashed.

Arm yourself against fraud with expert insights on the latest Iowa trends.