Avoid Common Mortgage Mailer Scams

As a homeowner, you'll receive a lot of mail, some of which may be deceptive. It's important to be cautious about mailers claiming to be from FSB, as they could be scams.

Table of ContentsContact a Mortgage Lender

Personal Details Exposed: FSB mail never exposes personal information like Mortgage ID, account numbers, or Social Security numbers on the outside of the envelope.

Verify Contact Information: Always check the contact information that appears on the mailer at FSB's official website.

Be Cautious of Urgent Messages: Scammers often create a false sense of urgency - FSB will contact you directly for urgent matters.

Authentic FSB Branding: Look for the official logo and consistent branding

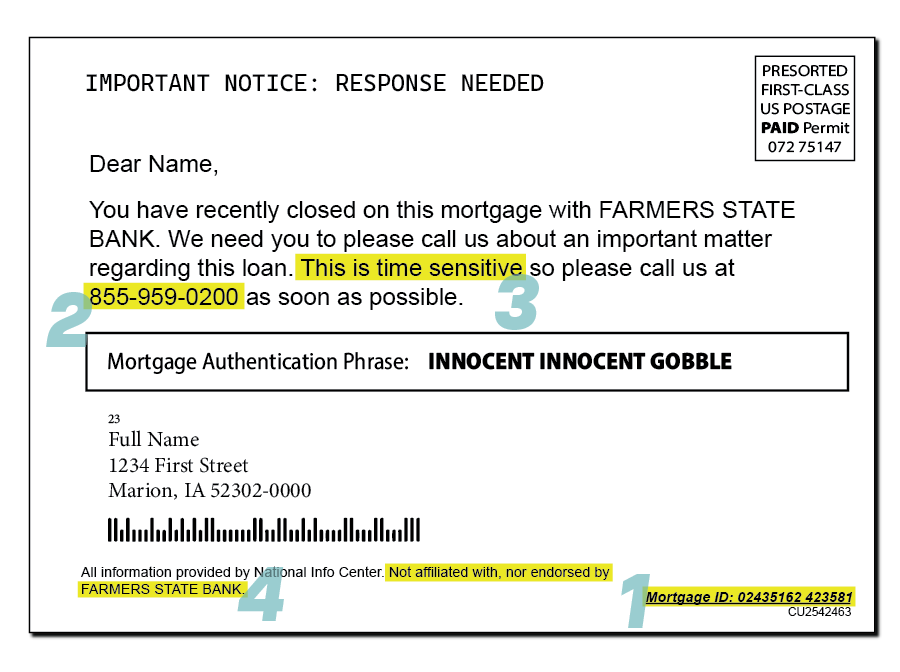

Look for Disclaimers: Legitimate FSB mail will not contain disclaimers stating no affiliation with the bank.

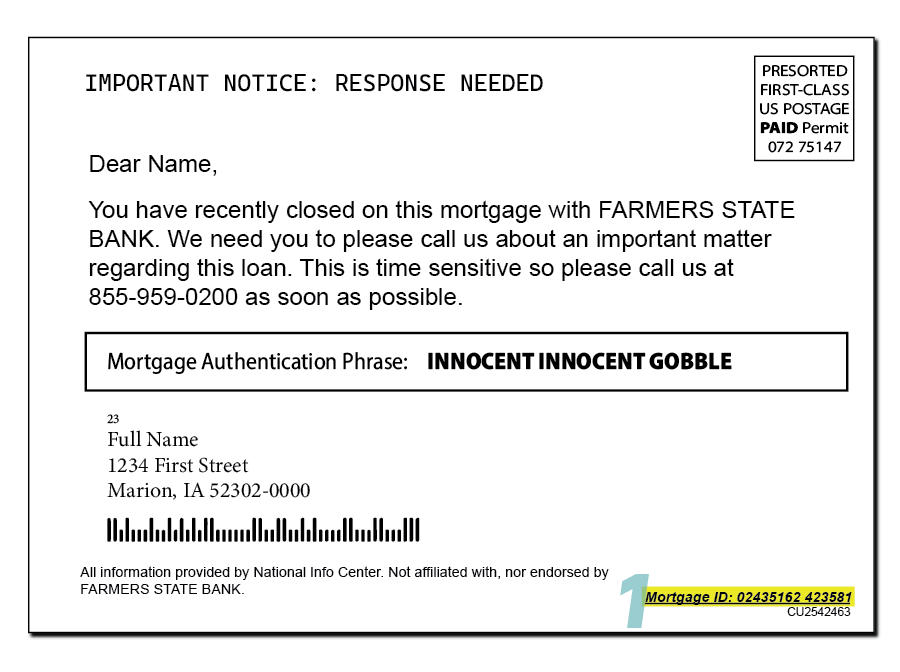

What To Look For: Personal Details Exposed

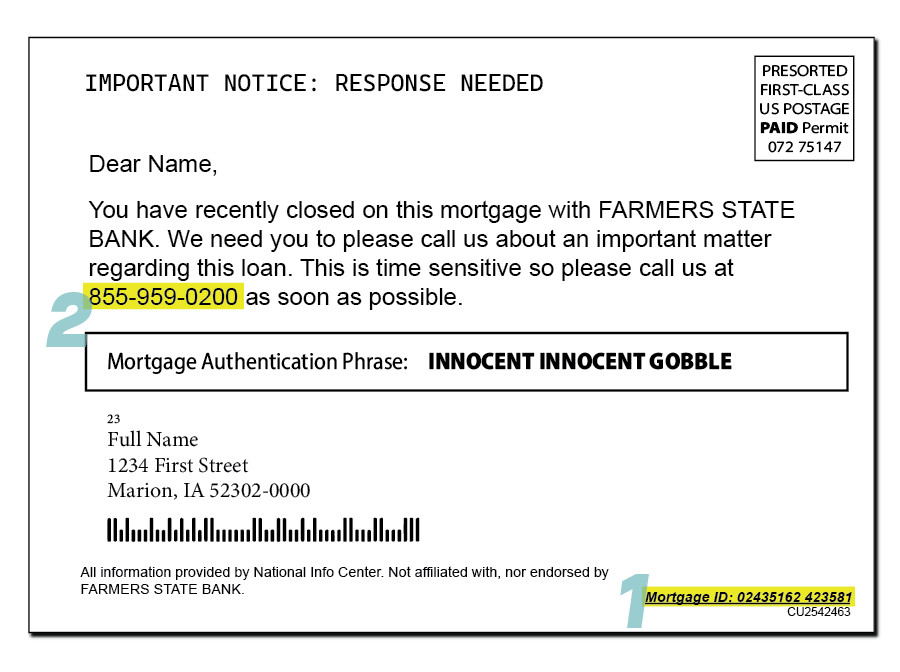

What To Look For: Incorrect Contact Details

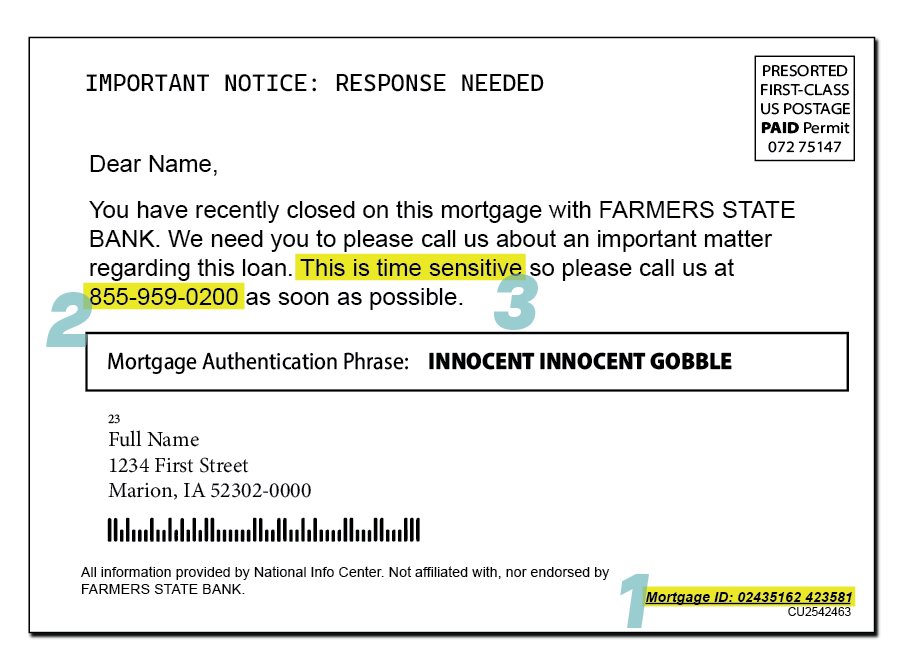

Recognizing the signs of fraudulent mailers can protect you from scams. Here's what to watch out for:

Mail from FSB will never expose personal information, such as your Mortgage ID, account number, or Social Security number, on the outside of the envelope. If you see these details exposed, it's a red flag that the mail might be fraudulent.

Always confirm the contact information on suspicious mailers to FSB's contact information. Fraudulent mailers often use fake contact information to mislead you. If the numbers do not match, it's probably a scam.

Be wary of urgent messaging. Scammers use urgency to prompt quick action and make you panic into responding without thinking. Remember, FSB will contact you directly for any urgent matters and will not try to pressure you through the mail.

If the mailer lacks FSB branding or includes disclaimers stating no affiliation with FSB, it's likely a scam. Authentic FSB communication will always display FSB branding.

The official logo is displayed, color schemes from other communications, and the language is professional.

Look for disclaimers such as "All information provided by National Info Center, Not associated with, nor supported by Farmers State Bank."

If you have any doubts about the legitimacy of mortgage-related mailers, please contact FSB's Mortgage Team directly at 319-730-6990.

Get quick answers to common questions about deceptive mortgage mailers and how to protect your information.

Explore the key differences and how each can help you as a buyer.

Discover how owning a home can benefit your long-term success.

Recognize the signs of counterfeit money to protect yourself.